Vacant Office Space in the Public Sector – Why it occurs and how to fix it

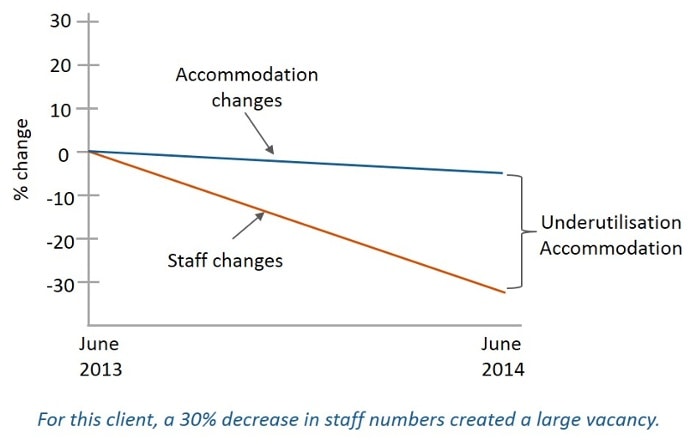

A while back I posted a short piece on a phenomenon which Grosvenor termed ‘Structural Vacancy’. It’s the situation that occurs when organisations reduce their staff numbers over a short period of time leaving a significant amount of vacant office accommodation.

More recently there has been considerable press about the extensive amount of vacant office space in the Commonwealth property portfolio.

For those that didn’t see my original article here is a simple diagram that demonstrates the fact that the supply of staff numbers is far more elastic than the supply of office accommodation over a short term.

Why does it happen?

When organisations downsize their staff numbers, they come under a lot of pressure to deal with the resulting vacant space.

The reality is that staff numbers are much easier to reduce than office space.

Put simply, if the average tenure of a commercial lease is five years then an organisation’s ability to significantly reduce its office accommodation will be limited by its ability to get out of leases. To add to that, large lease commitments are usually 10 years. So you get the idea of why large amounts of structural vacancy occur. To add further to the problem, if the market gets swamped with vacant space, then your chances of offloading your excess accommodation gets even harder. For many organisations it can take three to five years to get the supply/demand situation back to equilibrium.

This situation is not unique to the public sector. In fact, it is a regular feature of most corporate real estate portfolios.

How to fix it?

Major shifts in an individual business unit’s demand for accommodation within the corporate sector are common. Restructure, change in strategy and M&A work mean that the demand for accommodation is notoriously hard to forecast.

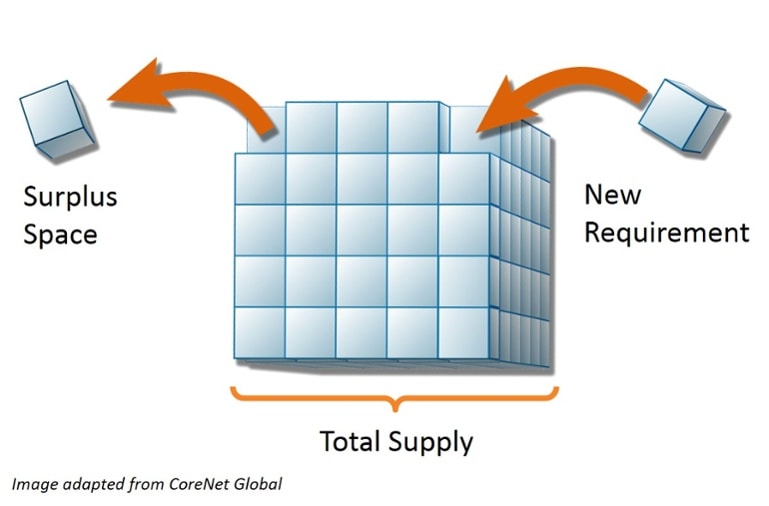

The traditional response is represented in the diagram below where one off business units managed the ons and offs of accommodation as single deals.

However, by managing the portfolio as a series of accommodation clusters, an organisation (or government for that matter) can aggregate supply and demand needs to better manage the whole portfolio.

Managing clusters of like-space or fungible (look it up!) accommodation is the first step to fixing the inevitable consequence of major demand side shifts.

That doesn’t mean you need to centralise the whole of a property function. In fact centralised property management for government portfolios can create more problems than it fixes if not done right.

So what needs to happen?

Centralisation of the strategic portfolio planning function. This ensures a whole of government perspective on all major accommodation moves in major centres.

By managing government office space like a corporate, and the departments like business units, a centralised strategic portfolio group could ensure the needs of individual departments are matched against the whole of government (organisation) requirements. This can be done without the need to centralise facilities management or project management which can be better done by the individual departments.

Balancing the business unit needs with the whole of organisational needs is what corporate real estate functions do.

In the Queensland, New South Wales and Victorian state governments, a centralised approach to managing major demand/supply of CBD clusters of office accommodation is already in place.

By modelling this structure and discipline in the Commonwealth public sector for the major clusters of office accommodation, a far better outcome for the tax payer can be achieved.

We are all about sharing our expertise to help you and your organisation be the best it can be.

We are all about sharing our expertise to help you and your organisation be the best it can be.