Approaching power imbalance in a supplier relationship

2 levers to shift the power imbalance in SaaS contracts

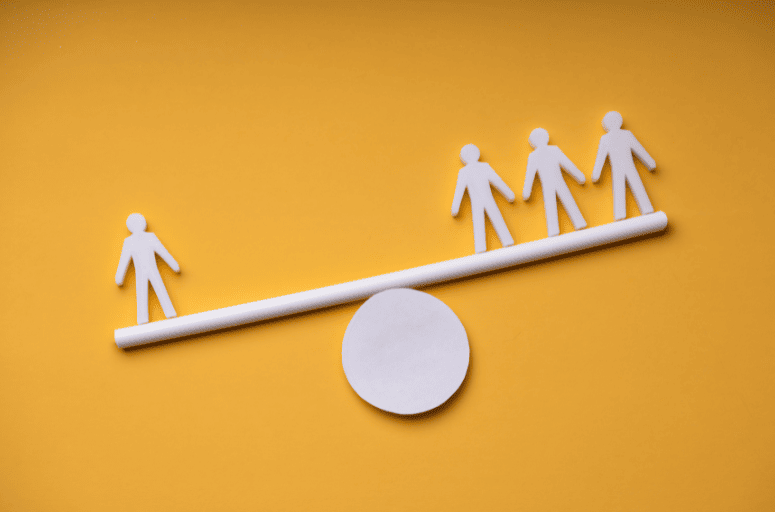

Maybe more so than in other contractual relationships, the power imbalance in Software-as-a-Service (SaaS) is high to very high. Not only is the other party often a large multinational company who is not willing to negotiate on product specifications, on pricing nor on contract terms & conditions, clients often find themselves also locked into the products they have chosen as re-training staff is very expensive and often there aren’t really any good alternative products.

Grosvenor undertook research with 30 organisations in Australia to better understand how the power imbalance inherent in SaaS contracts can be addressed. Here is what they said.

Respondents broadly recognised that managing the inherent power imbalance with SaaS providers as a difficult problem to manage effectively.

During the sourcing/procurement of a new SaaS product and/or the negotiation for the renewal of an existing product, they addressed the power imbalance as follows:

- focus on robust negotiations, including around price, contract duration and termination clauses

- ensure that performance clauses (SLAs and/or KPIs) meet the client’s organisational requirements

- press for penalties for non-delivery, including service level credits (and actually actively monitoring them and insisting on receiving the credits in case of underperformance)

- aim to understand what is valuable to both parties and negotiate for win-win outcomes

- limit the contract duration.

The second lever to pull is one of active contract management. In our wider research on getting performance form any type of supplier, we found that six in ten organisations actively manage more than 10% of their ICT contracts. Specifically, this included recommendations to:

· setting up clear and consistent communication arrangements

· scheduling regular contract management meetings

· ensuring that constructive feedback is consistently provided

· including contracts in a strategic partner management program.

For many clients dealing with monopoly suppliers in any category, we also found that building up an alternative supplier, or even a panel of potential alternative suppliers can be a ‘credible threat’ to the incumbent once the time for contract renewal arrives. This can be in the form of a small-scale trial of alternative products, or running certain parts of the business on different systems. Surly this comes with a trade-off, but in the long run it reduces the lock-in with a specific supplier.

We are all about sharing our expertise to help you and your organisation be the best it can be.

We are all about sharing our expertise to help you and your organisation be the best it can be.